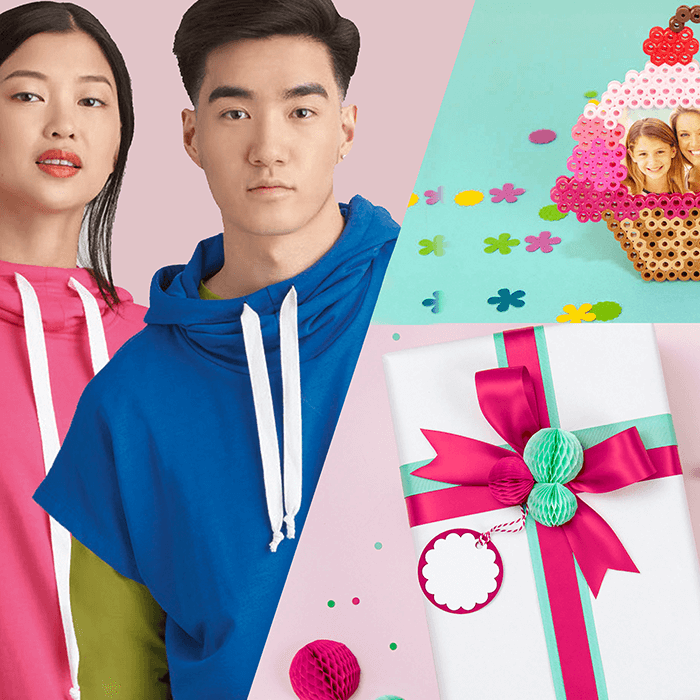

We inspire consumers to apply their creativity in ways that build meaningful moments worthy of sharing

Our Story

Learn more about our company, our teams and our diverse range of products.

Our Parent Company

Design Group Americas is a part of IG Design Group PLC – a diverse group of companies operating across multiple regions, categories, seasons and brands. For more information including investor relations and company results, visit the IG Design Group Plc website.